On Royalties, And Moving Forward

In less than 6 months the discussion about royalties will be over. What happens to the space after that fact is important to talk about.

Let’s start with a rough timeline of events quick:

ERC-721 and ERC-1155s were both created in 2018, and they are the most used standards for NFTs. You can’t put on-chain royalties on them.

Off-chain royalties were enforced across most marketplaces for roughly ~2 years (Q3 2020—Q3 2022).

The release of SudoSwap saw a lot more NFTs trade with 0 royalties, which was arguably the start of the conversation around it.

X2Y2 started the trend of optional royalties.

Blur released in October of 2022, it carried on with the push for optional royalties. And it led to OpenSea creating a blocklist of other marketplaces if they didn’t honour royalties after it’s marketshare was being eaten.

Blur responded by promising to enforce royalties for new collections to get out of the blocklist, however OpenSea declined their request as they said it needs to be done for ALL collections

Blur found a loophole by leveraging Seaport (protocol that OpenSea developed and relies on) to create a new exchange and automatically decide for the user. The thing is OpenSea can’t block it. Because if they did, they’d be blocking themselves.

Fast forward to Feb 2023, Blur has taken a fat % of marketshare from OpenSea and fought against them by pushing a solution to block OpenSea. OpenSea responded by moving to optional creator royalties. Blur 2 — OpenSea 1.

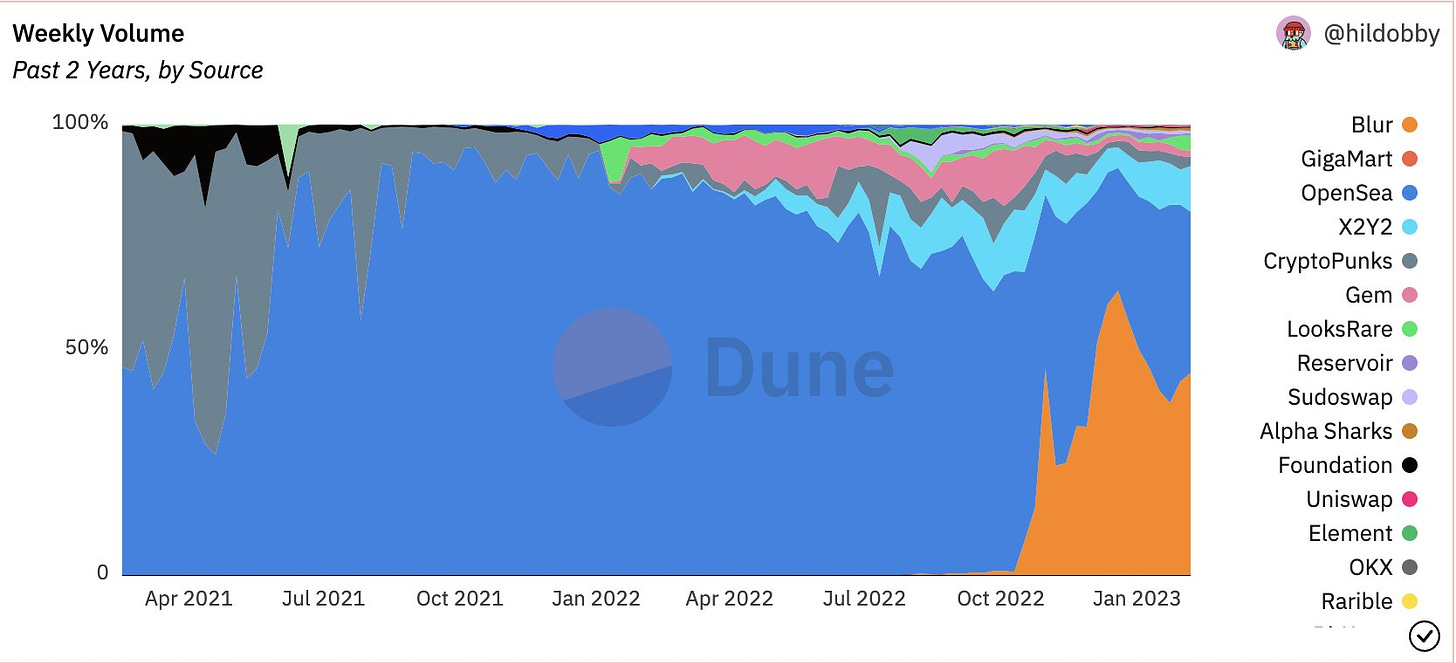

For a quick look at how insane the Blur numbers are and how much marketshare OpenSea is losing:

This article will be based on the assumption that <6 months down the line optional royalties is the norm, and marketplaces are now fighting to lower their own fees while they compete against each other. So the major question isn’t “What if we go to 0 royalties?” it is “What does it mean for the space?”.

Think of the era with royalties as sub-based games, and after 0 royalties as free-to-play being popularized.

So let’s break that down into 2 questions because it’s important to realise you have 3 groups of people that make a market: creators, traders and investors. I’ve been lucky to be on all 3 sides: Treeverse has raised over 700+ ETH in royalties, given hundreds of thousands away in fees and I still pay royalties where I can as a trader.

What happens to projects that lose a revenue source because of this?

It makes 0 sense to rely on royalties to run your business long-term. It is merely an additional revenue source that is nice to have. But marketplaces are switching to retain marketshare, not enough revenue for small projects and it’s technically unenforceable:

Many ideas on how to enforce on-chain royalties but the best way to decide if it’s worth it is by weighing the pros/cons,

I am of the belief that it is not worth sacrificing core elements of an NFT to save royalties, we should avoid going down that rocky pathway.

The harsh truth is any project that relied on such an unsustainable revenue source (of which they had no control) was bound to fail. This process just made it quicker. The alternative is pretty simple, the project needs to find more sustainable revenue sources. The funds you raise, in NFT sales or VC funding, should go towards a product. A product that will be your main revenue source. (SaaS, Game, Merch, Collectibles, etc). The strong will survive, and the weak will die while it gets harder for everyone.

What effect does this have on the space overall?

Here are some things I see happening over the next year. It impacts the market, which impacts all 3 groups (creators, traders and investors).

More subscription-style NFTs, hardly any one-time purchase for infinite utility

Without royalties, it makes no sense to provide continuous utility for someone who made a one-time purchase. Expect more sub-based models & harberger tax on NFTs.

More NFT sales + higher mint prices

Hardly any free NFTs from big projects unless it’s a user acquisition play. Mint prices will trend higher, and we will see projects release more collections diluting “overall” supply.

Quicker rugs

There is no benefit in driving volume if projects don’t benefit from it, we will see fewer slow rugs. It will happen quickly and you’ll find out if you lost your money 24 hours in!

Collections with blocklists

Regardless what I think of blocklists, it’s inevitable it will happen. The push for royalties will mean we see more upgradable smart contracts that continue to block contracts that do not honour them. Basically what OpenSea did but instead specific collections and projects doing it.

Projects that require a specific UX that marketplaces can’t offer will create their own marketplaces

Buyers run to where the listings are and sellers run to the liquidity. Art collections and blockchain games are examples where you have outside buyers buying for a different reason and individual marketplaces catered to a better user experience where I imagine royalties will continue to be honoured (this is an unpopular take but I stand by it, and will prove it with Treeverse).

It will be harder to onboard creatives.

Royalties became the norm a few years ago when a few OG artists pushed for it. This is why most of the old platforms had it and why new marketplaces challenge the idea. Royalties is a beautiful concept and I am still a massive advocate for it. Artists just want to create. Here is an extract from a piece I did in April 2021 on royalties as passive income:

Without this, we see more supply come into the market on the art side. And it’s harder to convince more creatives to enter the space. Even in Web2 it’s the norm—albeit a lot of platforms are predatory.

Marketplace fees start to trend lower

As said before, traders only care about their % gain. Fees are fees to them. To marketplaces it does matter, royalties don’t go to them, but their fees do. It won’t be easy for them to lower it but when pressured, they will. (note: most important thing is liquidity and product in that order)

Creatives keeping supply to sell on secondary market

As much as I am not a fan of this, it is still a solution. It has it’s own cons that will create arguments down the line (incentive for creators if they sold). This is ontop of additional revenue sources, and more in line with how artists replace royalties with something else on-chain.

At the end of the day, with all of these points included, it doesn’t mean the NFT space is over. Royalties become more of a social contract (as it always was). The space will still function, and we need to adapt with the times. Important to look forward. (P.s—There is an obvious trade in there somewhere)

I am 95% sure most of these things happen and royalties don’t come back to major marketplaces (even the current 0.5% will go to 0). Remember these marketplaces are businesses fighting to make money. They don’t care about you if your opinion makes them lose money, and you shouldn’t be loyal to them if you believe they go against what you stand for.

When you say that royalties are a social contract, are you speaking strictly in the context of web3? I ask because in traditional commerce, royalties are a legally binding contractual obligation, rather than a social one. In fact, royalties are a byproduct of the transfer of rights of usage. Can web3 replace traditional commerce if it can't offer the sane protections/obligations between creator and user/buyer.

Even if most artists don't clearly understand why an image is valuable, or how to capitalize on value that they manifest, I still think Web3 has great work to do in educating artists as to HOW web3 is a benefit to them in concrete terms. Especially if web3 is positioning itself as an alternative to traditional commerce.

"It makes 0 sense to rely on royalties to run your business long-term. It is merely an additional revenue source that is nice to have." - is grossly over generalized and the dumbest thing I've read on the internet today. Gj!

Otherwise, great article and summary of recent developments.