Discussing the "Line Goes Up" NFT criticism video.

In this article I'll be going through some of the points Dan Olson mentions in the recent viral video about NFTs. Most of what he talks about is true, just in a way to suit his agenda.

In this article, I’ll be discussing the viral video about NFTs recently released by Dan Olson from Folding Ideas. It’s a one-sided video where Dan takes factual information and construes it to fit his narrative. Some sections of data have been meticulously picked to show the negatives of the industry—but everyone already knows with good comes bad. It’s how the information is presented that makes a video helpful when informing others about the pros and cons of something, and this didn’t give off that impression. I’m not sure if it was Dan’s intention for the video to be like this, or he believes all of the points he mentioned; either way, I will debate some of them.

The Main Topic

Dan has a common occurrence of bringing up things that try paint all of Crypto in a damaging way. From the beginning of the video, he mentions people like Chris Dixon or well-known scammer Jordan Belfort that are in the Crypto industry. A few of the certain individuals that are in Web3, to an average viewer it screams the majority of those in Crypto is just the rich getting richer, or for scammers to continue scamming. It would be good to mention examples of Tim Berners-Lee who sold the NFT of the original source code of the world wide web for $5.4m at Sotheby's in an online auction. Or Edward Snowden who sold the NFT of an artwork made from pages of a US appeals court decision that ruled the mass surveillance program Snowden exposed had violated US law, for $5.4M (it went to charity).

One section of the video also includes an extract from an article written by Stephen Diehl, the same person that is a CTO of a private blockchain startup and also a very heavy critic of everything Crypto related, because it’s beneficial for him to be so.

The video is biased and conveniently mentions the bad more often than the good. Anyways, keep this in mind as it happens quite frequently throughout this 2-hour long video. I won’t be talking much about the Crypto section, as this article is going to primarily focus on the points brought up about NFTs.

NFTs

Meme creators are “cashing” in on the NFT hype after the $69M Beeple sale. Mentioning memes like Nyan Cat or Creepy Chan. (43:36)

The way such topics are spoken about cause a reaction in NFT-haters because of these “meme creators cashing in on the hype”. When the reality is some are still here today, like Prguitarman or Allison Harvard, creators of Nyan Cat and Creepy Chan.

They aren’t just here extracting and making money to then take it all out, but rather participating in the space.

I reached out to my friend Prguitarman and asked him why he entered the space, and why he is still here.

Prguitarman: “I joined the NFT space after reading about how artists are not only making life changing money but getting proper attribution to their artwork. It’s been tough to be recognized for my artwork these past 10 years but now my artwork is verifiable and celebrated by many people around the world.”

Generative artists raced into the space, lost a lot of money, and also weren’t quite sure what they were selling. (45:49)

If any attention is paid, it’s fairly easy to understand and ask questions that answer some of these things mentioned, at least before they race in spending money on gas fees trying to sell something they themselves don’t really understand. Not a fault or an issue of the space, similarly to how I could start a company in a field I’m not sure about and lose money.

It’s more of a representation of the artist who jumped in because they may have been promised “quick money” by a few individuals.

Claims of digital scarcity only apply to the token itself, not the “thing” (image) that the token is supposed to signify. The image associated with the token can easily be altered or replaced if the person with access to the server just changed file names. (47:04)

Many still don’t understand this in the space, unfortunately, due to misinformation spread by the “experts” who think they know what they are doing. But, this has been spoken about years before mainstream caught onto NFTs. On-chain vs off-chain.

As mentioned in the video, Ethereum can’t store that much data for most of these NFTs to be on-chain. But, some like Avastars or recently CryptoPunks, are on-chain.

Artists have their works minted as NFTs and “NFT-bros” claim to say they should have jumped in and minted their works as NFTs so people can understand it was theirs. (47:40)

This is a massive misrepresentation of the space and are comments that seem to be selected out of a cluster. NFTs aren’t the incentive to steal art to profit from it, art has been stolen for centuries. A more modern example is scammers printing random art on t-shirts and selling them, the solution given by others isn’t for that artist to make the t-shirt first, it’s that... they should report it.

Dan goes on to say this a few minutes after, which makes me confused as to why the point was brought up. Sure, it’s mentioning that bad things happen in the space too, but again it’s common throughout this video to bring up just the bad.

DeviantArt implemented an extremely well-received feature to scan several popular nft marketplaces for matching images. (48:15)

Great! But you’ve forgotten to conveniently mention that’s only a benefit of having a membership with DeviantArt, where you have to give them money. A feature blocked by a pay-wall that I would think most NFT-haters would despise.

Royalties can be easily bypassed because it’s not actually in the smart contract, but rather the marketplace that decides it. So people bypass it really easily! (49:37)

I want to express again most points brought up in this video are true, just spoke about it in a way to convey the negative attributes of a system that is still relatively new.

We as individuals can detect these sales that bypass royalties very easily, and it’s very common for 99% or more of sales to go through marketplaces because that’s where the liquidity lies, meaning artist royalties will happen quite often. Even in some cases, royalties are manually sent through to the artist if another platform is used, because we mainly believe it’s only right to do so. Others have their own beliefs that think royalties aren’t the best way to approach it. Either way, royalties are working.

Hundreds of thousands of artists bought in to only find that there wasn’t a new revolutionary highly traffic audience of digital art collectors, instead there was a closed market dealing in casino chips where the primary winners were those already connected who had the means to get the attention of the whales and media. (49:50)

This is a fact that is true, again, simply because the ease of creating an NFT is as simple as clicking a few buttons once you have applications set up. And, the money to actually buy the currency... can’t match the hundreds of thousands of NFTs minted daily. As much as you like to call this “magic internet money” 99% of NFT buyers have come in recently, without buying ETH or Tezos early. So a 10 ETH piece that is worth $30,000 by an artist who just minted, needs a buyer willing to buy that for $30,000! The supply exceeds the demand.

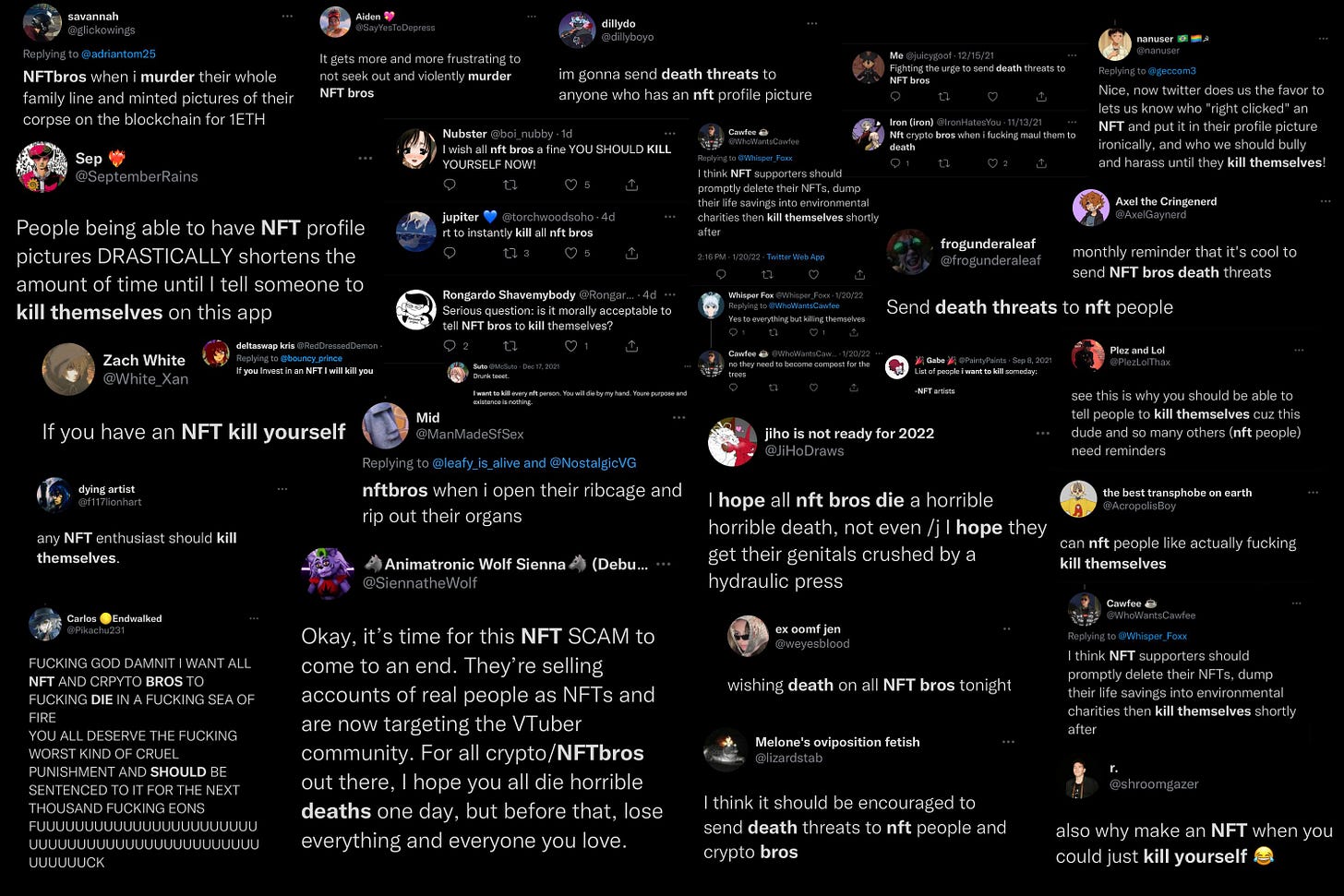

The primary winners were of course those who had a big audience, definitely not the only ones, I have personally bought many artworks from new artists (and I also made $ as a small artist). It’s actually a bigger problem for known artists to join NFTs now because of the hate they receive, which go as deep as actual death threats.

Even some of the biggest artists, they’ve never had the attention of whales in ways of connecting with them beforehand, the whales have had an eye on them as they liked their art and jumped on as soon as they heard they were selling NFTs. Such as Beeple.

The actual winners are those who had large balances of said Cryptocurrencies that are required to purchase for NFTs. (50:15)

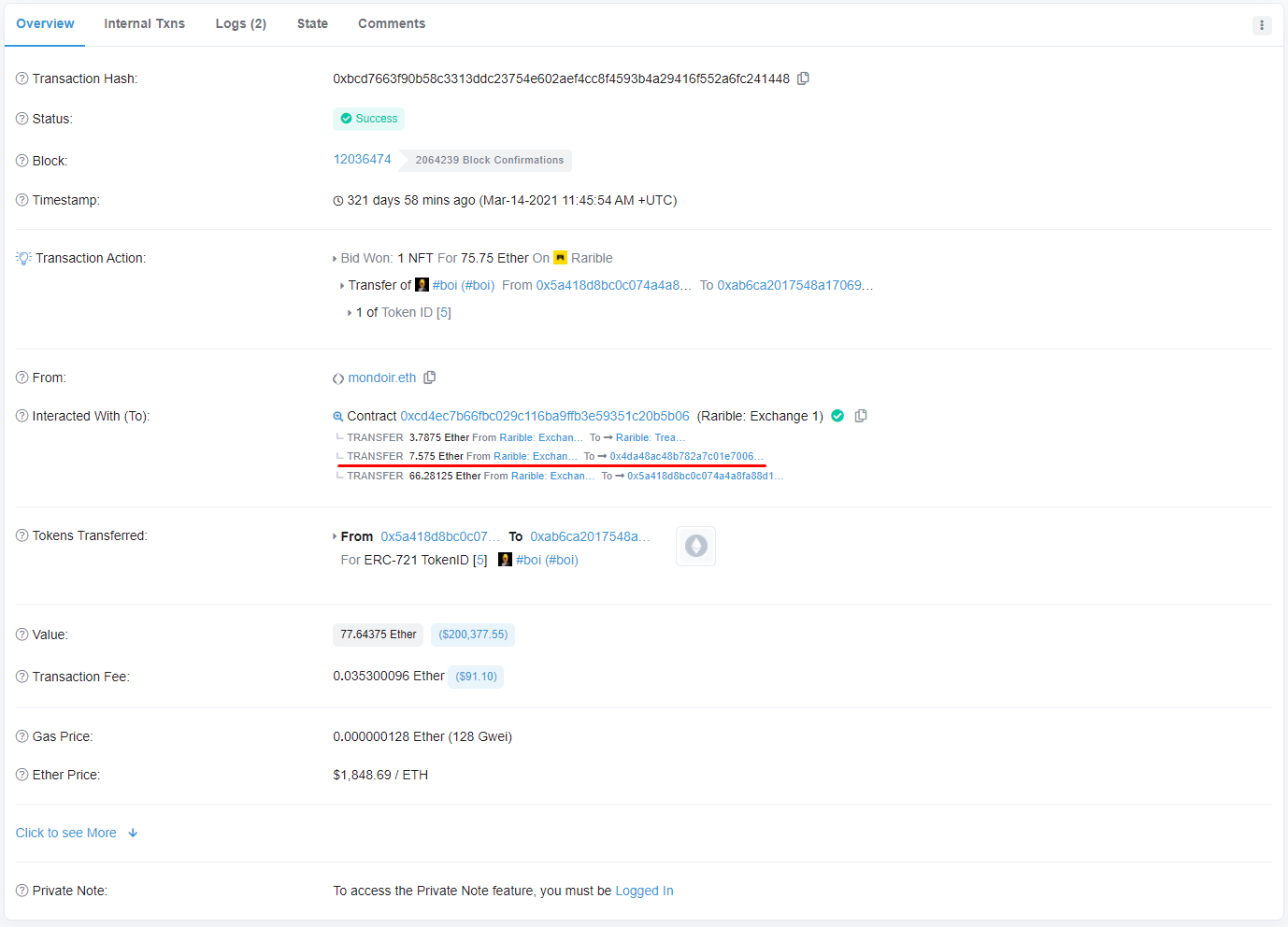

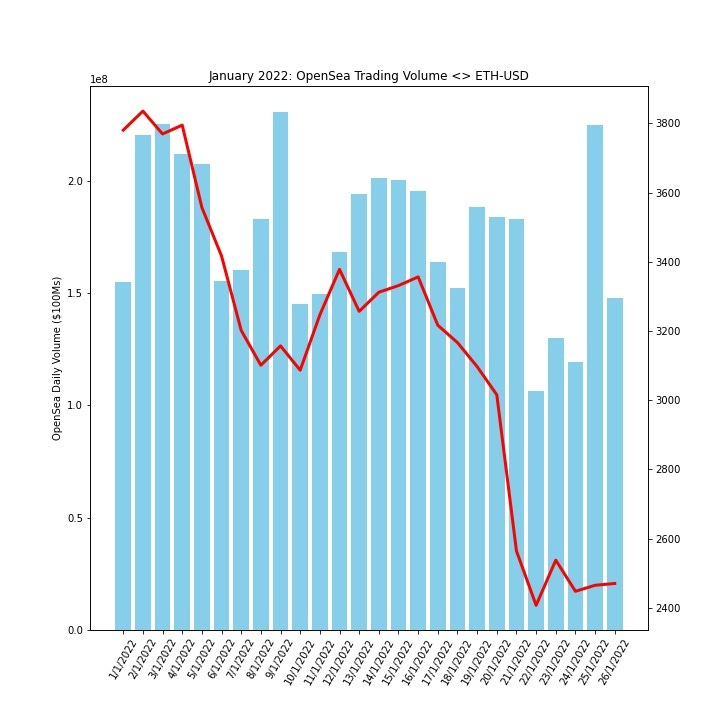

This isn’t always true, because NFT sales going up doesn’t mean the currency will now go up. As shown in the image below.

It’s true in the sense that it now gives value to Ether because... you can do more things with that currency now. Whether it be buy a monkey JPEG because I simply want, or to buy a ticket to an event like Veecon. It gives Ethereum more use-case, is that supposed to be bad?

Displays chart alongside notable NFT sales alongside the Ethereum chart. (50:55)

Now, this is an image with real data, manipulated by placing bits of information carefully in certain locations to give the wrong impression to those who may not understand much about the market. The idea that something like a $36K NFT sale [Bad Luck Brian] could even move the price of a 12-digit asset is absurd, it didn’t even affect the market.

“Whales selling off their ETH at the top” is funny like they know how to time it, and anyone not in Crypto would believe it since they could research and find most points are true. Do a bit of research and you’ll realise it’s a very funny statement to make. It’s trying to tell the future. But, of course, massive selling = dump! That’s how the market works.

In the last 3 months, over $9.1b worth of NFTs has been traded on OpenSea, with January breaking all previous records. In the same time period, ETH is down more than 46%.

You are the sucker for buying something at $4,000 because you weren’t as early for buying it as the person at $4. (51:25)

Basically, how every market works. If you are early, you make more money. What is this trying to say?

Whatever you buy now, might be worth 100x in the future. (51:40)

Again, another VERY true statement. And one that is everywhere if you were to search up on platforms like YouTube or TikTok because it gets clicks and hungry people looking to make fast money. The truth is, that the smart people in the space understand is that those people that misinform others of the space are the actual scammers.

I or many others in this space laugh at these things, and it’s unfortunate because it is what the public see, rather than my continuous warning that 99.99% of things are going to 0 and... I will never say you will 100x your money in a specific NFT. Bad apples in a bunch, again.

Greg Isenberg section about people who make fun of NFTs have never dug deep into NFTs. (55:45)

Picking an example of someone who was never actually Crypto-native nor NFT-native and came in at later stages talking about NFTs (typically making super wrong statements) and calling himself an expert.

However, if you are hating on NFTs to the point where you want people to kill themselves over it, you probably should understand what you actually hate. So Greg is true in this regard, just could have been worded better.

[a section of calling out many scam nft projects that invited him to discord] (59:00)

Funnily enough, 90% of the projects he mentioned are unknown to many, and 100% have an ulterior motive to push you to join a popular discord.

It’s like me talking about the scam calls I get on my phone about my insurance, nice, not representative of the space as a whole. If the video was all about the bad side of NFTs, it would have made more sense, but Dan is generalising the whole industry.

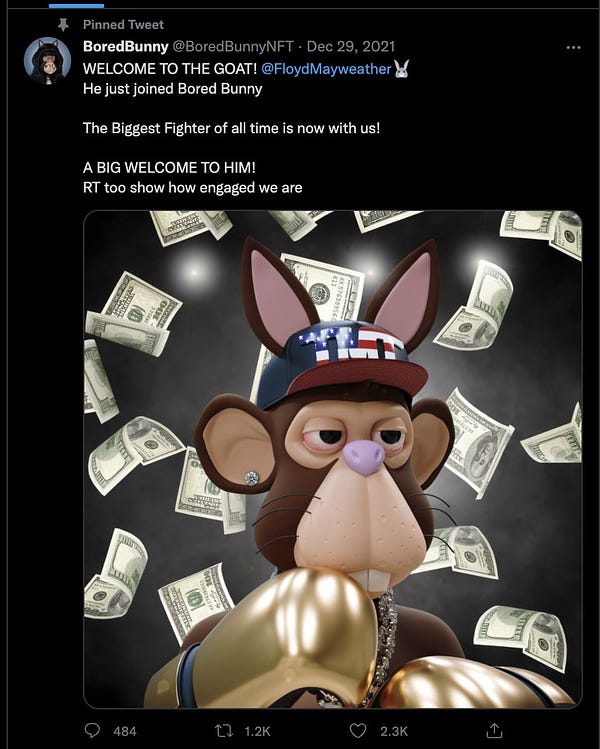

It’s considered bad if the project founders don’t help inflate the market price of a PFP. [1:01:04]

Good points brought across, because this is very true, it’s happened to me multiple times and it’s very funny to see these buyers think I would engage in such activity. And the same for many founders. But, you have project founders that actually do it! And the buyers are simply the ones who come in after being misinformed by the youtube video calling for a “100x” or by their favourite celebrity getting paid to promote it.

The art is bad. [1:01:10]

Small sections and statements said across the whole video, using this one as an example, it’s taking out the collections that have Fiverr artists working on them, made in days.

I personally think some art is good but I could just be blind right?

Pretty much all of them claim to give you a financial return. [1:05:09]

Now, here is one of the false statements mixed in with all the facts in the video. Pretty much all of the biggest NFT projects will tell you are buying a token, others telling you that the money raised will crowdfund a roadmap that will be worked on by the team. I can’t name ANY big projects that promise financial gains, maybe 1 in 1,000 that either exists or hasn’t crashed by now.

Reminder: anyone can create an NFT project and claim to give you a financial return… you should be looking at the top projects, not any random ones.

Picking out sections from laughable, and unknown NFT projects explaining their vision [1:07:00]

A few minutes before this section, Dan did say he joined scam NFT projects so what did he expect? But then he went on to these funny projects like “Nftits” and read the sections out that had a funny roadmap with foolish visions.

More than an hour into the video, Dan has still picked the worst examples of projects to analyse.

Talking about gm/gn, ngmi, wgmi... [1:14:59]

I truly think he may have just come across the wrong people and wrong comments rather than the ones who will tell you “wgmi” is just a meme, where the truth is we know losers will be more common than winners. So I begin to believe, he isn’t spreading wrong misinformation with an ulterior motive, but just came up on the bad side of things and is now generalising the whole space on it.

Anyways the way he tried to basically say “gm” that stands for “good morning” is evil, is pretty funny.

Wash-trading on NFTs [1:26:32]

This has been brought up a few times in the video, wash-trading seems to be the thing that confuses newbies and new NFT buyers that the item is valuable. Not true by any means of course, it’s very obvious to see something bought for more than what the market is valuing at, and 95% of the time... it never works and harms the buyer who has to pay fees on that item itself.

It’s simply not a big problem as people make it out to be, because the idea that wash-tradings’ main goal is to incentivise buyers to pay a premium on a token must mean that it’s working if people still wash-trade... right? No. I’m not sure Dan could even show me a few examples of wash-trades with links to the transactions, that have then fooled buyers into paying a premium for an NFT. They are outliers.

Section where Waka Flocka loses 19 grand after trying to sell an NFT dropped in his wallet. [1:29:49]

Minting NFTs to other wallets happens, and scammers take advantage of individuals who may not know much about security.

The only difference is it’s not a user actually “listing” or trying to “sell” the NFT. The smart contract will try to get you to either give your seed phrase through a phishing website or get you to approve a smart contract with malicious code. Both examples, have extra steps and can be caught out very quickly if you concentrate enough for you to actually know what you are looking at. Selling a legit NFT has a completely different process from trying to sell a scammy NFT. It’s like buying something from an online store... and transferring money to someone FOR something from an online store.

So, in this example, Waka Flocka basically gave out his bank details to someone who said they were going to double his money.

Axie Infinity Naavik Article [1:42:42]

This article is actually an amazing example (with no bias) about how the current Play-To-Earn games work. One of the first examples OF a play-to-earn game is Axie. After they blew up, you can now see how others started to replicate what they were doing to cash-in fast. The difference is Axies’ SLP (play-to-earn currency) isn’t sustainable because of how the tokenomics model worked. I am working in this field too so I believe we have found a way that makes sense as blockchain games shouldn’t be play-to-earn but play-and-earn as a bonus. It shouldn’t be pushed as a game where “everyone can earn”. As he said, it’s treated the wrong way so it has it’s flaws.

This is using an example of one game/tokenomics model of a successful example which may have crashed and now generalising the system, again.

Conclusion

This is one of the better videos I have seen on NFTs and the problems they have, throughout the video, 99% of what Dan mentioned are facts. It’s just conducted in a way that suits his agenda and it fuels more rage into NFT-haters who may think they now understand the space from one video.

Frankly, I believe Dan does understand more about NFTs than a huge majority of others who make videos on them. I think he is just confused why people might spend 6 figures on a monkey JPEG in any scenario, especially since that’s more than people earn in years from working normal jobs. People dislike the idea of NFTs because if you can’t comprehend someone rich spending money on “luxurious” items bought purely for a “social flex”, then it would obviously outrage you. Just the outrage has reached insane levels, it’s now a trend to “hate” NFTs. It’s practically impossible for what Dan wants to happen, which is an open market without scams, I don’t want scams to keep happening nor does anyone with morals. But it’s human nature for evil to exist and exploitation will carry on happening.

However, this being the first “good criticism video” about NFTs, is pretty sad. Because it still isn’t. And, if an argument against NFTs was made talking about the good points, the content creator or celebrity would probably get cancelled. That’s how mainstream thinks now with some individuals that even have an internal thought process of “NFTs will never ever have a good reason to exist and if you try to argue against me, you are part of the scum that needs to be eradicated”.

great response, I think somebody should respond to the crypto section as well cuz a lot of youtubers "critiquing" "crypto" don't even bother to go into the concepts behind them which they deem problematic, they just take prominent scams like web3 and other fail altcoins and explain how they failed and equate it as critiques of the entire thing, I think its because they don't want to learn and tell others why its bad they want to rage on it and rationalized rage sells big

I see few rebuttals to his objections to the purported practical use of cryptocurrency, what crypto actually makes better in any way that it purports to (besides being able to make transactions without a bank account), or what, exactly is a problem that crypto attempts to solve that isn't a problem created by crypto itself. Dan starts off his segue way into NFT's by leading with the solid point that crypto can't buy common things, never has, and doesn't look any closer to being there. If one cannot defend crypto, is it not unfortunate that any defense of NFT's is incapable of defending the entire ''currency'' structure that it relies on?